the course is essential for learning how to build financial models that help analyze and forecast a company's or project's financial performance.

to buy to buyThe Financial Modelling course provides students with the skills to build and analyse financial models to make strategic business decisions. Participants will learn techniques for forecasting, creating financial reports, evaluating investments and modelling business processes. It is a crucial tool for making informed business decisions and evaluating investment opportunities.

The course is aimed at professionals who analyze financial data and need to create models for forecasting and evaluation.

For individuals managing businesses who want to use financial modelling for planning and making strategic decisions.

For those making investment decisions and wanting to better assess the financial outlook of projects and companies.

For those starting a career in finance and looking to acquire essential financial modelling skills.

Cours Financial Modelling consists of 22 blocks that maximally pump the future specialist and allow you to become confident.

form of education & price

Our vision of Financial Modelling learning is not just learning concepts, but also mastering practical tools that will help you bring your ideas to life. We create educational programs where theory and practice become one, where you get not just knowledge, but real skills for successful work in this dynamic field.

01

Schedule:02

Period:03

Age:04

Class time:after graduation on course of Financial Modelling you will be able to:

Building Financial Models: Ability to create detailed and accurate financial models for various purposes.

Analyzing Financial Data: Skills in analyzing financial data and interpreting results for decision-making.

Forecasting Financial Metrics: Capability to forecast future financial performance of a company or project based on models.

Evaluating Investment Opportunities: Skills in assessing the attractiveness of investment projects and companies.

Scenario Development and Sensitivity Analysis: Ability to develop scenario analyses and evaluate the sensitivity of models to changes in parameters.

Scenario Development and Sensitivity Analysis: Ability to develop scenario analyses and evaluate the sensitivity of models to changes in parameters.

Using Excel and Other Tools: Experience with Excel and other tools for creating and managing financial models.

Preparing Reports and Presentations: Ability to prepare reports and presentations based on financial models.

Optimizing Business Plans: Skills in using financial models to optimize business plans and strategic planning.

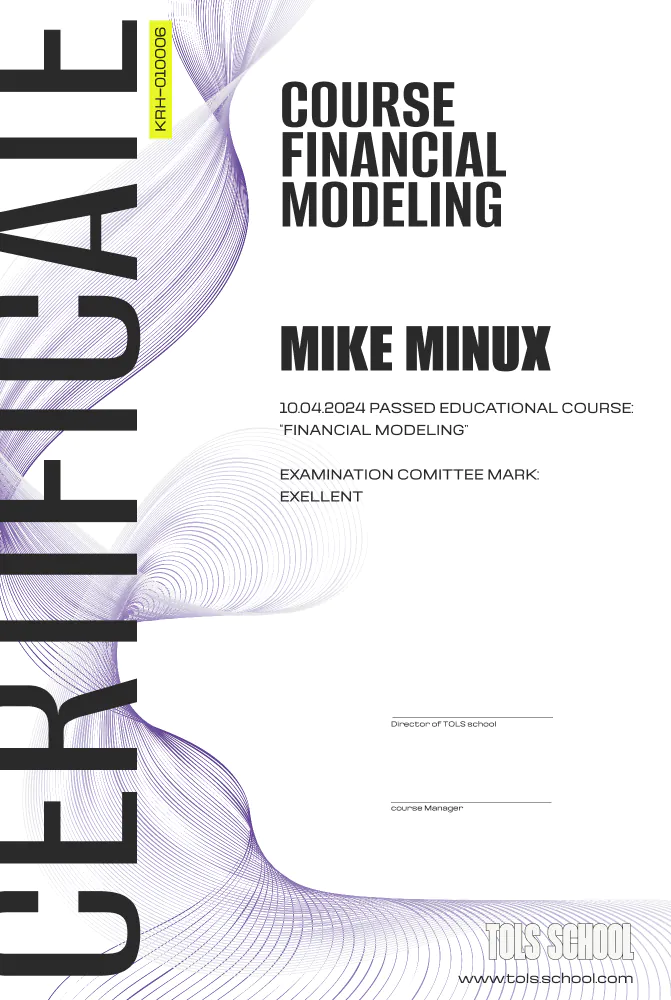

A TOLS School Certificate of Completion is an important tool that can have a significant impact on your career and professional development. It validates your skills, gives you a competitive advantage, promotes career development, broadens your professional horizons, is recognised in the professional community and contributes to your personal development.

leave the application - we will contact you. we will tell in detail about course programs and book a place in the group for you.

Thank you!

Your form has been submitted.

our manager will contact you shortly

for cooperation with us leave your summary (with marked “i want

to join your team”) and we will contact you as soon as possible